Practical and Helpful Tips: Money

The spouse that is surviving is usually the primary beneficiary to the credit shelter trust and it will also be named as trustee. The remaining life of the surviving partner, the income and moreover the principal of the trust can be used by them for the care of their health, education and likewise maintenance. Exactly when the surviving spouse dies then the property would now have the to go to the children and it won’t be included into the estate of the surviving spouse, the entire 7 million dollars will go to the family without the estate tax and this is a living trust planning.

Why No One Talks About Funds Anymore

In case this method is not used 1.5 million dollars will be the estate tax will be charged upon the death of the second spouse. The bypass trust can in like manner offer protection from claims made by creditors and it will ensure that the property will remain in the family and if the surviving spouse remarries then they won’t have the ability to give the property to the new partner.

Smart Tips For Finding Resources

Related Posts

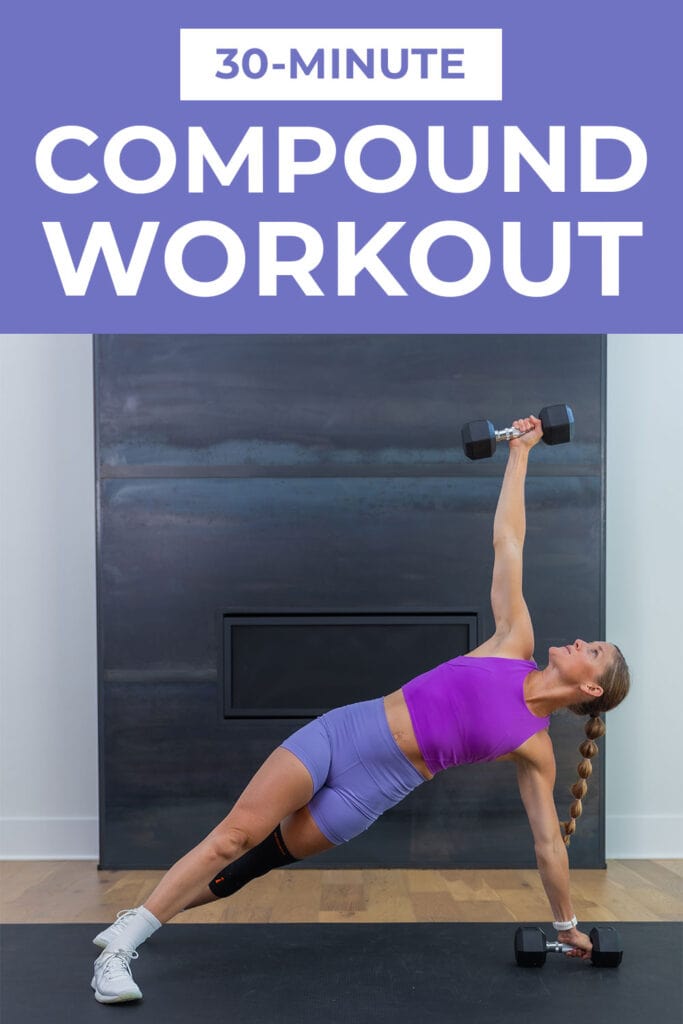

Unleash Your Strength Everyday Full Body Powerhouse

Everyday Full Body Boost: Ignite Your Fitness In a world that never slows down, finding time for fitness can be a challenge. However, with the mantra of “Everyday Full Body…

Best Calamine Lotion Soothing Relief for Itching

Finding relief from itching can be a frustrating endeavor, but with the right product, soothing comfort is within reach. Let’s explore the benefits of the best calamine lotion for itching…